Change Password

How I influenced Online and Mobile banking to look deeper than the original ask to force 9 million clients to change their online passwords

RBC • Online and Mobile Banking

As the Lead Interaction Designer, I worked with other Interaction, Visual, and Content designers in Online and Mobile Banking in a quick discovery phase that revealed how this project would impact clients.

From inception to implementation, I worked with Product and Technology in quick iterations to ship fast.

Once implemented, I collaborated with Researchers and Product to demonstrate the real "under the surface" problem and potential risks for the business, such as a spike in calls after once clients change their passwords, along with possible ways to mitigate it.

Ultimately, that led to the project's expansion, with more pieces added to the roadmap.

_______________

9 million clients had old passwords that didn’t comply with the most recent security guidelines.

They were either too weak, too old, or lacked the most recent encryption level. That exposed clients to fraud and RBC to security and reputational risks.

Business

Case

Enforce the new security standards by proactively prompting clients to update their non-compliant passwords, while minimizing the impact to advisors in the assisted channels (call centre, branch, chat, etc.).

Project

Objective

The current Change Password flow was hosted in and old platform that didn’t offer the most recent encryption levels and accepted passwords that didn’t meet the minimum requirements.

Main

Challenges

01 Outdated technology

02 No pro-active PW maintenance

There wasn’t a pro-active mechanism to prompt users to change their passwords, or a design pattern to use for this type of communications with clients.

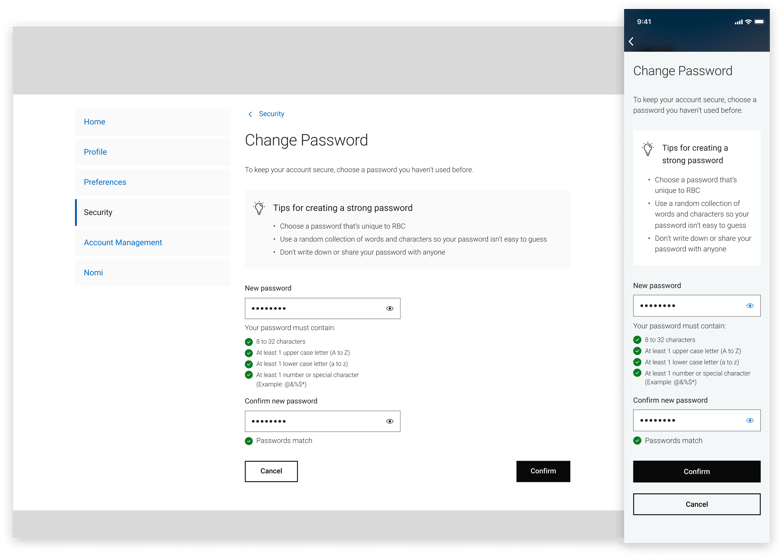

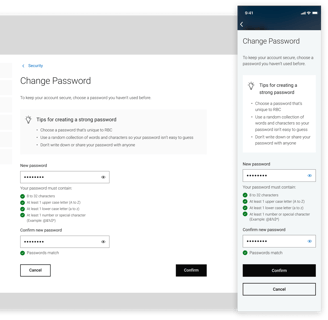

03 Not available in the Mobile App

The Change password flow was not available in the Mobile app, only in Online banking; however, about 30% of users were mobile only; 27% were hybrid.

04 Tight deadline to meet compliance

Matching target dates and release schedule resulted in having less than 2 months to ship the solution; design had less than 3 weeks. Because it’s a Compliance issue, this was a Severity 1 project.

Clients with non-compliant passwords will be targeted and forced to change their passwords upon sign-in.

Original Business' input

Design's proposal

After running a quick Design Discovery sprint, the team had a better understanding of the problem from the user perspective and how the original solution could result in a spike in calls. Once presented to stakeholders, they were convinced that we needed a more progressive approach to communicate with clients.

Why? Because...

"Forcing clients to change their passwords will disrupt their online banking experience, resulting in confusion, frustration, and increased calls to assisted channels."

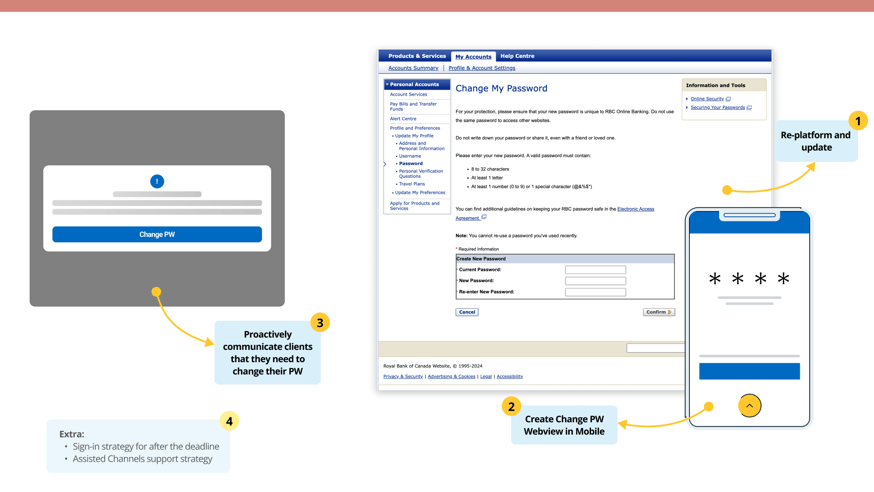

The final solution was broken into four main efforts:

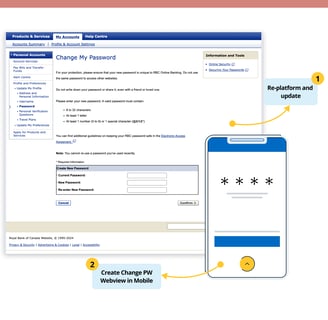

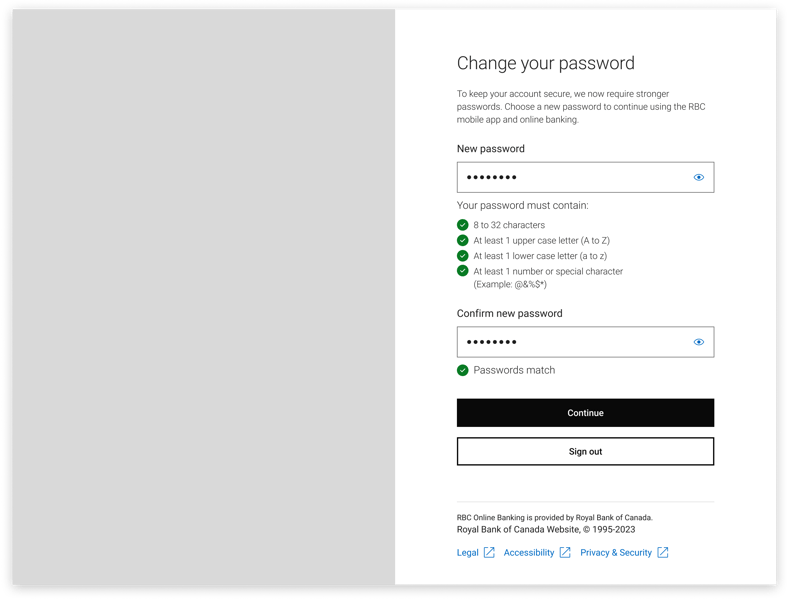

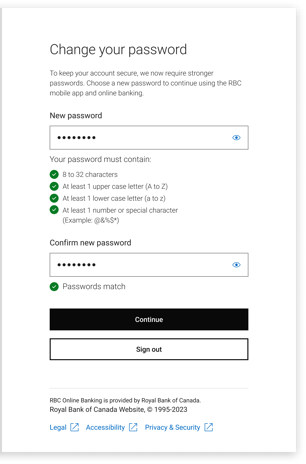

1 - Re-platform and refresh by incorporating the recent guidelines and following the current Online Banking UI patterns;

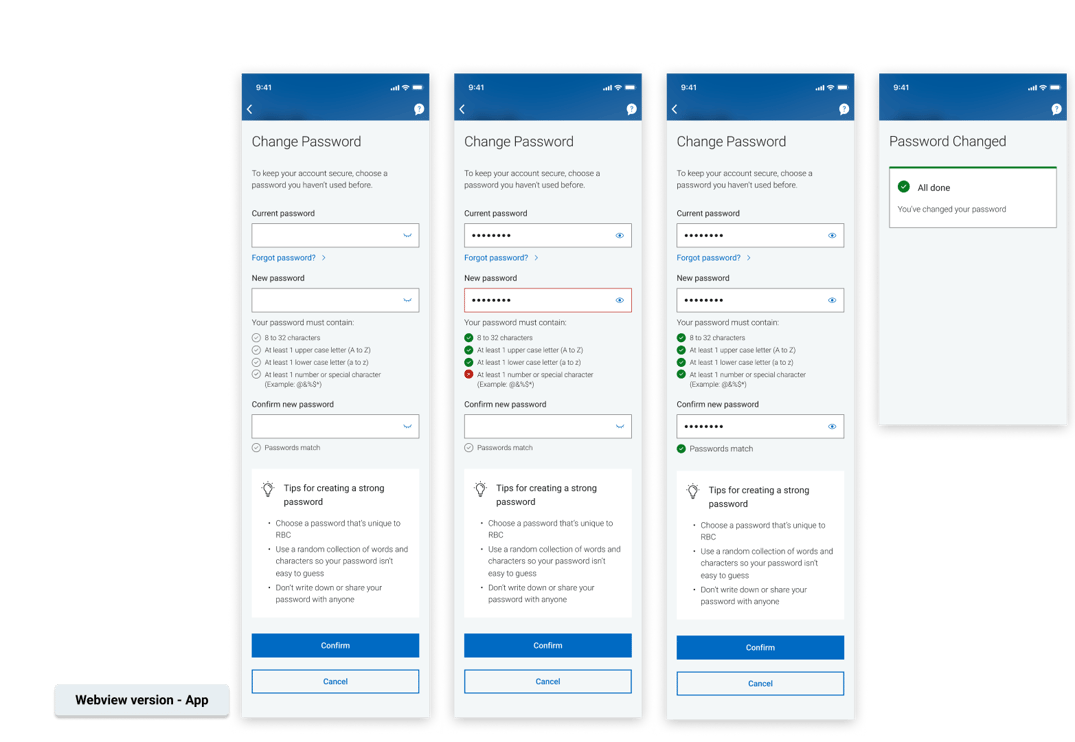

2 - Develop it as a webview, to be consumed by the Mobile App, to speed up shipping and extend the functionality to almost 3 million clients.

*30% of users are mobile-only and 27% are hybrid (mobile and desktop).

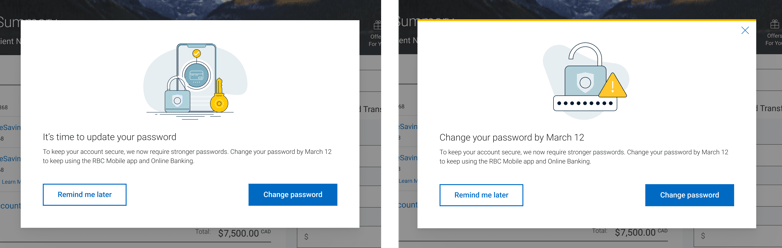

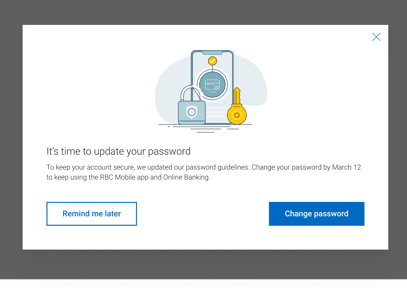

3 - Marketing communication intercept modal upon sign-in starting 60 days before the deadline; the message gets more assertive 30 days before the deadline:

4 - Force password change 60 days after the targeted campaign initiated by prompting clients with non-compliant passwords to change their passwords upon sign-in.

Solution

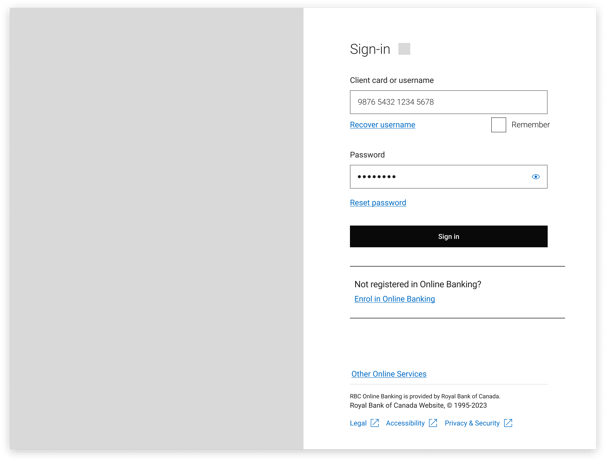

Initial designs

Final Implementation

After several iterations and compromises...

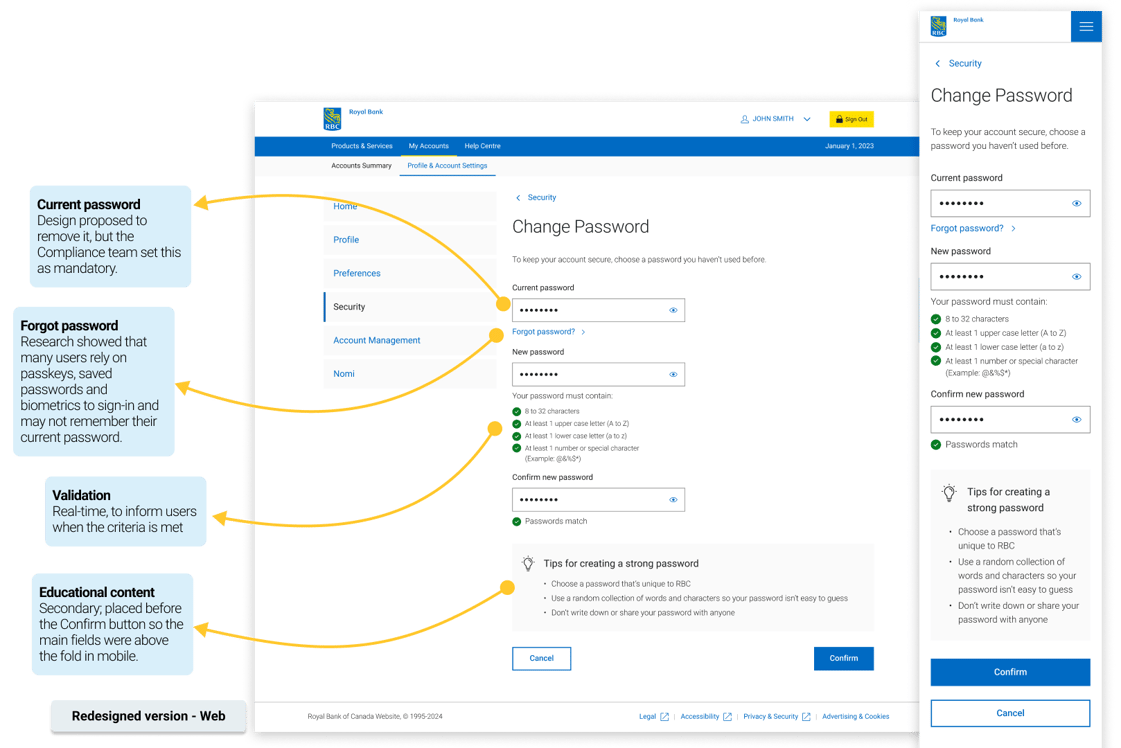

1 and 2 - Re-platform, refresh and make it available in the Mobile App -- Most relevant changes made after stakeholder alignment and Research:

"Current password" field: Mandatory as per Compliance; we needed to add it back;

With that, Research revealed that many people may not remember their current password as they use passkeys, biometrics, or have their passwords saved on their devices;

Tips: moved down after realizing it got too prominent and pushed all the fields (higher priority) below the fold; also, that part couldn't be validated by our back-end.

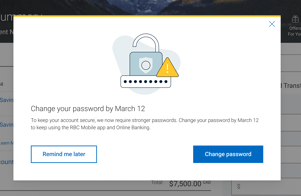

3 - Marketing communication intercept modal upon sign-in starting 30 days before the deadline; the message no longer changes over time:

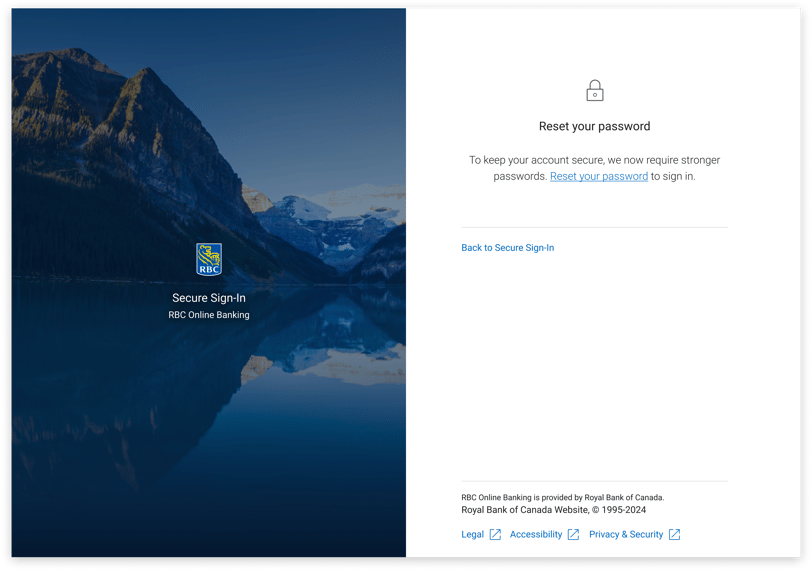

4 - After 30 days the targeted campaign is initiated, send users to the existing Reset Password flow instead of asking to change their passwords on the same sign-in screen:

Staggered approach

Run multiple campaigns with smaller groups of clients as a way to mitigate the impact on Advice Centre.

Pilot

Test live with 40K users to measure the impact on Advice Centre channels before opening to millions of clients.

Root cause and consequences

Human memory limitation

Underestimation of password strength

Lack of awareness/education on password security

Low motivation to create strong PWs

Harder PWs are hard to remember

Avoid changing it

Reuse PWs across multiple sites/apps

Lead to...

Which results in...

Clients who are vulnerable to fraud

Security and reputational risks for RBC

Clients mindsets

How clients may feel when signing in to RBC to do their banking and are asked to change or reset their password:

Annoyed 🙄

I don’t like to change passwords because it’s hard to remember

I don’t remember my old password

RBC is telling me to change my password

Confused 😒

I don’t know how to create a strong password

I don’t know how to keep my password safe

I don't understand why I have to change it

Unsure 🤔

I don’t think I’ll remember my new password next time I need to sign in

Confident and at ease 😎

RBC has my best interests in mind

RBC worries about my safety

I will change my password because I want to keep my account safe

Why people avoid changing passwords or creating weak passwords:

Usability test insights

With a grain of salt...

Familiarity

Participants were familiar with other websites and apps that requested them to change their passwords upon sign-in

Clarity

The message to change their password was considered clear and direct. All participants understood what they had to do and what would happen if they didn’t act by the target date

Annoyance Vs. Importance

Changing passwords is not a top-of-mind task because people have memory issues. However, several participants recognized the importance of keeping their accounts secure and appreciated the bank's proactive approach to protecting them.

Minimal disruption

Forcing clients to change their passwords wouldn’t cause a significant disruption on assisted channels. None of the participants said they felt they would need to call after seeing the message.

However....

"The real risk for burdening the assisted channels actually comes after clients change their passwords."

Due to...

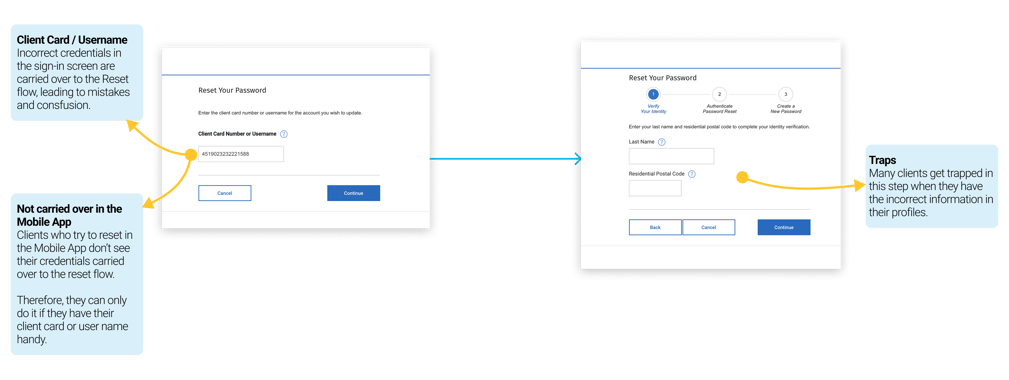

Confusing Reset Password flow:

The current Reset Password process has multiple steps where clients get stuck:

Last name and Postal code - when they enter information that doesn't match their profiles

2-step verification - when they don't have a mobile device

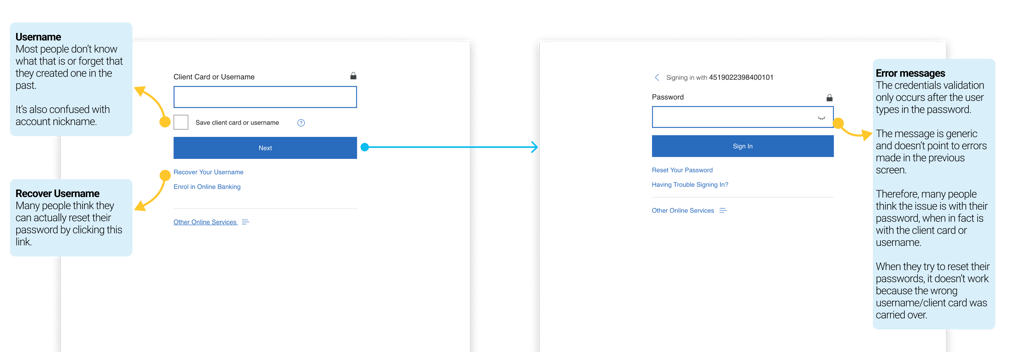

Confusing Sign-in that leads to Reset failure:

Current sign-in is split into 2 steps that happen on separate screens

Error messages are unclear and don't help users to self recover

Mistakes made on sign-in are carried over to the Reset flow

Final proposal

It was clear that to avoid a spike in calls related to Change Password, what we actually needed was:

Streamline the Sign-In and Reset Password flows

Force users to change passwords right on the sign-in screen, rather than taking them to the Reset Password flow

Re-think the ways we allow clients to sign-in and reset/change their passwords altogether

New proposed sign-in in one page

Added to the

product roadmap!